Humans are lousy at math and probability.

Math-Challenged

Math anxiety is real, and it is not altogether misplaced. For example, 40 percent of 12th-grade students tested below even basic mathematics achievement levels in the most recent national survey from the Educational Testing Service. Generally speaking, most of us are “math-challenged” in some significant way.

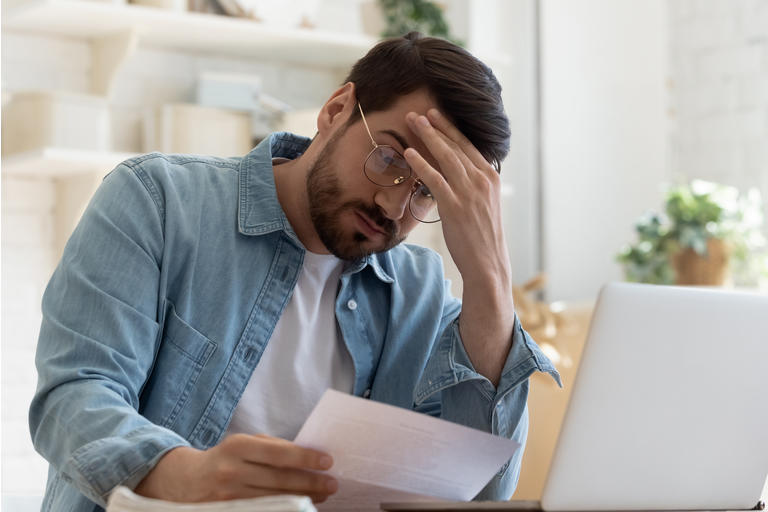

We are all prone to innumeracy, which is “the mathematical counterpart of illiteracy,” according to Douglas Hofstadter. It describes “a person’s inability to make sense of the numbers that run their lives.” Math is hard and often counterintuitive.

For example, most people would consider it an unlikely coincidence if any two people would share the same birthday in a room with 23 people in it. People would generally look at it like this: since one would need 366 people (in a non-leap year) in a room to be certain of finding two people with the same birthday, it seems to make sense that there is only a 6.28 percent chance of that happening with only 23 people in a room (23 divided by 366). However, 99 percent probability is actually reached with just 57 people in a room and 50 percent probability exists with only 23 people (see more on the “birthday problem” here).