Thứ Sáu, 12 tháng 6, 2015

Thứ Ba, 9 tháng 6, 2015

6 Money Goals You Should Conquer in Your 20s

Are you a twenty-something who feels overwhelmed by your personal finances? You're not alone. When you're just starting out and learning to manage your money, there's a lot to learn and many milestones to work toward. How do you know what to prioritize? What should you accomplish first?

From http://www.dailyfinance.com/

Use this as your guide to goals. Gaining these achievements will put you in a great position for financial success throughout the rest of your life. If you're in your 20s, start working now to accomplish these six money goals.

4 Reasons Why You'll Never Be a Millionaire, and How You Can Change That

From http://www.foxnews.com/

Relaxing vacations on the French Riviera, huge donations to your favorite charity and an early retirement. These are the kinds of things people think of when they hear the word “millionaire.”

It’s unlikely you’ll ever experience that. Sorry.

Unless, of course, you can overcome the following four roadblocks stopping you from achieving millionaire status. Each roadblock below also offers an “immediate action step” to help you overcome the things holding you back. Let’s get started.

1. You don’t understand how money works.

Money is not a complicated topic, but still, few seem to really understand how it works. Do you? Sure, you can blame the school system or your parents, but the responsibility is still on you to figure out how money is made, how it is held, how it is invested and how it is preserved.

Millionaires understand that money is not something that is discovered, won, or created by chance.

As I stated in my previous column, 5 Powerful Books That Changed the Direction of My Life, wealth is not an accident, but an action. Building wealth is the world’s largest game, and if you want to win, you need to learn the rules. So start studying.

Immediate action step: Start by reading several great money books, such as:

- Rich Dad, Poor Dad by Robert Kiyosaki

- The Total Money Makeover by Dave Ramsey

- The Richest Man in Babylon by George Clason

But don’t just read, internalize the knowledge. Debate it. Talk about it with your spouse, grandma and mail carrier. Personal finance can be learned, and by mastering it, you might discover that wealth is much easier to build you previously thought.

Thứ Hai, 8 tháng 6, 2015

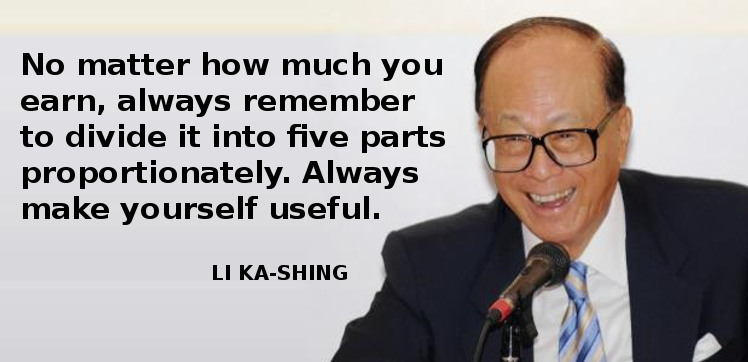

Li Ka-Shing teaches you how to buy a car & house in 5 years

from http://e27.co/

Hong Kong billionaire Li Ka-Shing shares some of his money wisdom, outlining an inspirational five-year plan to improve one’s lot in life

This article is translated from the original Chinese by Edmund Ng at CeoConnectz.

Suppose your monthly income is only RMB 2,000, you can live well. I can help you put money into five sets of funds. The first $600, second $400, third $300, fourth $200, fifth $500.

The first set of funds is used for living expenses. It’s a simple way of living and you can only be assigned to less than twenty dollars a day. A daily breakfast of vermicelli, an egg and a cup of milk. For lunch just have a simple set lunch, a snack and a fruit. For dinner go to your kitchen and cook your own meals that consist of two vegetables dishes and a glass of milk before bedtime. For one month the food cost is probably $500-$600. When you are young, the body will not have too many problems for a few years with this way of living.

Đăng ký:

Bài đăng (Atom)