Original by Wolf Report at Seeking Alpha

https://seekingalpha.com/article/4407082-1m-portfolio-value-goal-reached

Summary

- I did not expect my portfolio value to climb as it has during the first two months of this year.

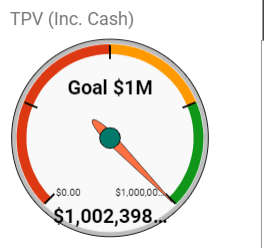

- The combination of excellent performance, nearly 9.3% portfolio growth in 2 months, and continued injections of capital pushed my aggregate portfolio value to $1,002,398,30 as of February 15th.

- While this may a point to shrug at for many readers/investors here with far higher portfolio sizes, it's a "check" for me, who started at zero age 25.

- I go through the changes which can now happen in my investing style.

I decided years ago that upon reaching a total portfolio value + cash of $1M, I'd look over everything and decide how I would if in any way, change or adjust my investment approach once this goal was reached.

(Source: Author's Data/Calculations, Google Sheets)

To be clear, I'm not talking about net worth. Of course, some of us own assets like houses, cars, properties, or other things, the inclusion and potential liquidation of which could put our net worth above $1M rather easily. What I'm talking about is actual, investable cash either currently invested in stocks, bonds, commodities, or something as simple as a cash position.

It is that value that has now risen to above that stated target. There are a few factors/considerations to this and how this could have risen to this size as quickly as this.

- FX. Without the dollar facing some lower exchange rates compared to the SEK, this position could have been around $80-90k lower. My SEK position is closer to 8.4M SEK at current levels, but the goal was always USD, for several reasons.

- Capital inflow. When I started at age 25, with a grand total of $832, I had the ability to contribute perhaps $400-$500 per month if that. I was a poor student, quite literally working my first "real" job. I currently contribute about ten times that and have done so for 2-3 years at this point.

- Dividends. Over the past 8-9 years, with the last 4-5 being the real ones of significance, I've collected over $93,500 in dividends post-taxes (taxes being at most 2-3%). This year this is set to breach 1M SEK, or $100,000, an impressive number for me. Over the past few years, this has grown to near-excessive numbers, at current levels of $40,218.72/year on an NTM basis.

- Valuation investing is something I got into in early 2016 when I discovered SA and many of the investment concepts which now form the core of my method. It took me a while to find my "place" with valuation investing, meaning the initial year or so still saw a bit too much risk in the overall investments I made. I've since then adjusted this, and I'm probably rare because as an investor, I've never had a mistake that's "cost" me more than 0.5-1.0% of my available capital - and other investor's war stories have kept from investing too much in anything, and towards the end, severely limiting any sort of risk.

At the age of 35/36 years, it means that I have (at least) another 30 years of work ahead of me if I want to, and it means the portfolio, provided that I remain healthy and active, will continue to grow respectively for at least that time before any sort of serious retirement.

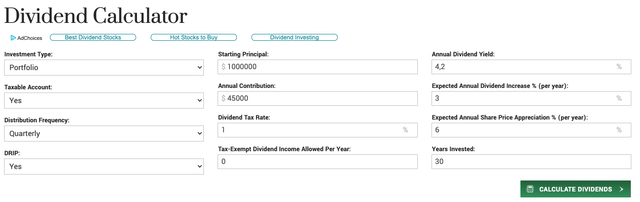

Even if I don't contribute another single cent to this account, and withdraw every single dividend that's paid out as it's paid rather than reinvest it, at an average growth rate of no more than 6% per annum, this brings the portfolio size to around $4M in 30 years, and average monthly dividends of $14,500 (Source: Z2036, Dividends Investment Calculator).

Any sort of further monthly contribution or dividend reinvestment as a percentage of paid dividends significantly changes this for the better, to a potential, based on the following assumptions.

(Source: MarketBeat)

The assumptions are relevant as an average tax rate for the combined accounts in Sweden amounts to around this, provided I continue to maintain deductible costs (mortgage, etc.) to balance up the potential 1-3% flat tax rate - though it may be that in the end, this will increase to a level where I actually have to pay an annual tax based simply on the size of my portfolio.

The end result of the above, which assumes that I continue working at/about the same level as I am today, with around the same income, and contribute the same amount of money apart from reinvesting dividends, is a portfolio size of around $42-$43M with annual dividends of around $4.4M.

This shows, as an example, the sort of development we can expect for a conservative portfolio centered around the investment in dividend-paying stocks.

Changing things up

So, a certain type of goal is reached, and the stats of my core portfolio are now as follows.

| Portfolio value | 7,959,398.00 kr |

| Cash Position | 340,000.00 kr |

| Total Portfolio Value | 8,299,398.00 kr |

| Total Portfolio Value, $ | $1,002,201.27 |

| Total Dividends, SEK | 333,115.00 kr |

| Total Dividends, $ | $40,225.60 |

| Yield (ex-cash) | 4.19% |

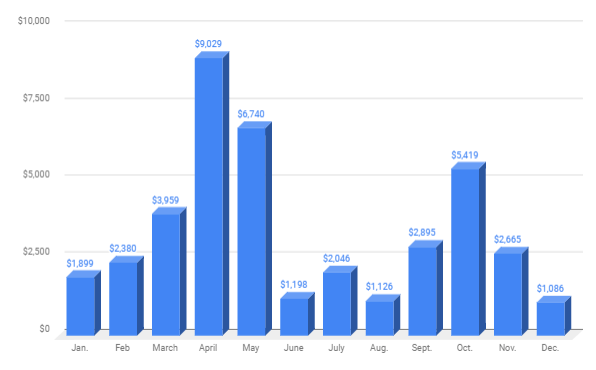

I still have a not-insignificant cash position that needs to be properly invested going forward, and which due to the way Scandinavian dividends are paid out, will increase significantly going forward the next few months. Here are the currently expected NTM dividends for the coming 10 months.

(Source: Author's Data/Dividend Calculations, Google Sheets)

This does not include dividend increases that may be coming, non-dividend incomes/cash flow, but only dividends that have currently been announced or adjusted. As my initial portfolio goal has been reached and my overall expense coverage ratio from dividends alone is now breaching well over 165%, I'm making some of the changes including some of the changes I announced at the beginning of this year, or my 2020 wrap-up.

I've already announced I've begun with options trading, slowly and carefully. Another change I'm making is that I'm now open to, at least theoretically (though I expect doing the first investment into it will take time), growth investing, without necessarily an immediate expectation for a dividend.

(Source: Nyfosa)

I've done growth investing in the past, but it's always been sort of an involuntary sort of thing.

An example of this is the company Nyfosa (No Symbol), a company where I was assigned about 1500 shares over 2 years ago as a result of an opportunistic real estate spin-off from one of my favorite Swedish real estate companies. The spin-off had a targeted portfolio value of 25B SEK until it would begin to pay a dividend. Due to faith in management, I held onto my shares at a cost basis of around 35 SEK (the original price). They are now trading around 80-90 SEK, and they just announced their first dividend payments through 2020/2021, with an extraordinary dividend, pushing the yield to nearly 5%, and the total RoR to over 236%, including payouts, with the position, now being nearly 1.6% of the total. This is a good example of something I would consider a decent growth investment.

Growth investing can indeed be very lucrative if done correctly. However, doing so is much riskier than investing in blue-chip dividend stocks, many of which have bond-type levels of overall safety.

My reason for investing in growth-type stocks is very simple.

(Source: Us news money)

When investing in Dividend Stocks, I'm looking for an 8-16% annual CAGR, consisting of both attractive dividends and capital appreciation over time due to a mix of quality, undervaluation, dividend growth, and fundamentals. The stocks here have already, in many cases, reached a mature potential, which limits future growth but also caps theoretical downside risk. It's a very appealing sort of investment when you're building your fortune, but don't want to risk too much downside.

When investing in Growth stocks, we choose a company that hasn't yet reached its full potential.

It requires far more research and the picking of companies that have the potential to grow at extremely rapid paces. Rewards here over time, unlike the former, have the potential to go into four digit-percentages over relatively short periods of time, and anything less than a 20-30% earnings/revenue growth on an annualized basis is only marginally interesting to me.

(Source: Marketing Land)

It's my stance that many investors do this approach backward.

They begin by investing in Growth stocks, hoping to create the sort of mass of capital they can then invest in safer dividend stocks in order to live off their massively-saved up principal, gathered from growth stocks. That's how many of the people I meet argue - that they'll invest in safer companies once they have a few million to invest.

Me, I've always looked to first create at least a baseline level of safety, in order to use this to catapult capital into somewhat riskier investments, but with the potential to grow at these digits, thereby elevating my net worth to untold heights (for me), while still retaining my SWAN-type sort of safety.

I doubt that I will ever be able to by myself or the day job that I do create the sort of capital that goes into eight or nine digits. There's just not enough time for me, and I don't work in a field where such a thing would be possible. However, investing capital the right way in growth opportunities, it's entirely possible this could be achieved.

In my articles, I often say that the point of a company I review isn't to turn $10,000 into $100,000 in a short period of time.

That will actually be the case with the growth investments I will start to look into. I want that capital to grow that fast, and I'm ready to take some more risk to do so.

Are both possible?

Many investors ask if both things are possible - to combine the appeal of massive amounts of pure growth with large amounts of appealing dividends. I would argue that this is only possible with very specific companies or very specific situations.

Take the pandemic crash in March of 2020. The capital I invested in quality companies there, have in many cases appreciated more than 100% inclusive of dividends. That's an excellent growth rate when you consider it's actually less than a year of time.

But this is an example of a very rare type of situation which can allow that sort of capital appreciation or growth, based on a massive mean reversal after a crash. It wasn't based on that the company grew their earnings, but rather things reversed back to more of a "Normal premium".

So while it's possible in certain situations to, rather easily, get annualized RoR of over 100%, this is not the norm.

Certain companies can provide the same. I recently wrote an article about Anthem (ANTM), which is currently a favorite investment target of mine. This company has extreme overall levels of safety and is set to grow earnings at well above 10% for the next 3 years. While it doesn't make the company a pure "growth" stock, I would argue that it has growth-like characteristics, and there have been times when EPS has grown 20%+ for a longer period of time.

(Source: F.A.S.T Graphs)

67% in 3 years certainly isn't a bad number, nor is 20% over 3 years annualized. If you look at Alphabet's (GOOG) 9-year averaged annualized ROR, it comes to about 22.7%, which is nearly double the S&P500, but not that much higher than the 3-year expected annualized RoR for Anthem. It all depends on the company on the time period you look at, of course. At different time periods, GOOG has outperformed this by far.

So, are both things possible? I would say "sort of", but equating a mature, blue-chip dividend stock to a growth stock in every way defeats the purpose in some ways of investing in growth stocks. We're looking for stocks that maintain excessive growth over time, as of yet-immature companies where we can enter and be part of the initial growth, which can create returns in the thousands of percentages over time.

Growth and Value investing, in the end, are two different approaches to investing in companies. Growth investors seek growth in earnings and revenues, value investors seek undervalued stocks/equities.

Some other key characteristics of Growth stocks include

- Higher priced than the broader market, due to willingness to pay a premium for a higher earnings growth.

- Higher earnings growth records than established, mature companies, as a way to "prove" that they are indeed growing at a pace that can justify their premiums.

- More volatile than the market, due to the risks involved. A simple earnings call can cause a double-digit stock price drop. Risks are simply higher.

So far, I've exclusively focused on value stock investing, and any growth investment has been involuntary or as a result of something else.

Do we want to do this?

Those of you who saw the potential calculation for the portfolio, assuming continuous dividend investments, may ask yourselves if there's even a point to this sort of investment when the continuation of the original strategy could result in such returns.

I would argue that yes, it is - but not "just to do it".

Any sort of growth investment needs to be weighed next to blue-chip dividend investing, and the potential return needs to be higher on a risk-adjusted basis. There's no denying that growth investing produces superior returns in a shorter amount of time if done right - but doing so takes a significant risk and loss tolerance, willingness to do research, and foresight.

I don't yet have any potential targets for growth investments, and I realistically believe it will be some time before I feel comfortable enough investing in a company like this, needing to do the research, risk assessment, and similar factors.

The point is, however, that this has now become an option to me, and provided I find the right opportunity, I may indeed use it and broaden my portfolio.

Bargain hunting is one thing - value investing. But finding the "Next big thing", which is essentially what growth investing is, is never easy. You're not just up against the world's best investors, you're up against yourself. And a guy like me, with paltry (comparatively) amounts of capital at my disposal, can only hope to at this time scratch the outside of things.

To me, the way that many growth investors argue, such as Phil Fisher saying that he "doesn't want many good investments, but a few outstanding ones", is an easy thing to say if you already have your bottom line and your basic life protected no matter what. It's something I view as impossible to do if you go into growth investing wagering essentially what is supposed to be your safety for the rest of your life.

I would therefore take everything famous investors like that say with a bunch of salt.

Identifying the first targets

It's easy to talk about all this, but here is my actual strategy for attempting to identify these stocks or opportunities. None of these parts/steps are in any way unique, but you're welcome to add and comment your own.

1. Historical Earnings growth

While some are okay with just revenue growth, I want a history of growing earnings, and a strong one.

2. Forward Earnings growth

The historical earnings growth should be projected, and expected to continue as before, or higher.

3. Margins

Margins indicate the relationship between revenue and costs (and earnings), which is crucial. Strong margins indicate that management controls cost very well, which is one of the more important points as the company progresses - because those are your earnings.

4. RoE

RoE is a favorite metric for many investors, as it indicates that management has been, and maybe successful in the future, in growing shareholder investments.

There are a number of methods for identifying attractive targets - and really, each investor has their own method. A good one that I've found is William O'Neil's CAN SLIM system, which attempts to identify companies with strong fundamentals and capture them before they make major price advances.

I've yet to apply this to any specific target, but the targets I look at can be really anything - from stocks in the EU, to stocks in NA. One advantage of being an EU investor is having access to the native listing of virtually every smaller stock or growth potential stock across these markets, and this means I can pick and choose rather extensively.

Of course, this can also be quite risky.

Wrapping up

This is breaking new ground for me. It's something that, looking back, has materialized 3-4 years prior to my early expectations of portfolio development. However, having reached current portfolio targets and values, I feel that the time has come to learn more.

While it would be entirely possible to simply stick to what I consider an extremely successful strategy, I'm someone who thrives on learning new things - and delving deeper into this is something I've been looking forward to for some time.

I don't recommend growth investing for someone starting out or someone who hasn't created what I consider a baseline sort of safety for the simple reason that the risks are far greater than with value investment. I fully expect to make mistakes here, and mistakes can mean capital loss - not something you should be consciously including or aiming for if you're just starting out.

Again, don't expect me to publish articles on growth stocks on a weekly or even monthly basis going forward - just know that I may start looking into these as potential investments if I can find one that to me seems a decent investment with an above-average rate of return when considering the risk involved.

SA and its readership, as well as the many connections and bonds made here, have shaped my investment approach and changes for some years - and for that, I'm truly grateful as well.

I hope you all have a wonderful day, and that this piece was of some interest to you, shedding some light on the future focus of my pieces.

Disclosure: I am/we are long ANTM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.

Some good comments:

Trả lờiXóadeebkk: Excellent ! If I may , allow me to suggest not to get cocky , stay with what worked for you , your back is covered already , why would you want options cannabis EV bitcoin and other such exotic but unproven vehicles

Also work at something you enjoy , no stress job , retire early maybe 50 and move to warmer climates ; you'll live longer ; for what is worth that is what I did but I started planning for it at 30 , over 40 years ago ! Anyway enjoy !

Investing for Freedom: @deebkk I am thinking the exact same thing. I mean how much money is enough? As long as it is sufficient to leave you stress-free, there is no reason to try fancy but riskier things attempting to squeeze out more.

deebkk: @Investing for Freedom Absolutely ! I keep asking others at what point do they feel enough is ENOUGH For me it was years ago ,I have about 25 stocks I don't trade , just collect dividends ,and about 10 positions of maximum 50 shares each whereby I 'm in and out ; basically doing it to keep sharp , I'm already of a certain age , and for entertainment At this stage I rather spend and HELP others vs. squeeze one more $ P S Your name tells me you have the right idea .Next to Health , Freedom is a good thing.

clrodrick: Congrats!!! Welcome to the millionaires club that has a lot more members today than it did 20-30 years ago thanks to constant currency devaluation (inflation). You are a great example to show to any young adult just graduating and entering the workforce as to how having a plan and discipline to keep at it can be extremely rewarding. For me, I've always had a bit of a plan to separate the core of my investing from investing in growth. Basically my first goal was to max out my 401(k) along with Roth. 401(k) funds (which annually are a lot more than Roth) get put into basic stock funds focusing on large cap and a bit of small/mid-cap as well as international. Then my Roth money would be put into various growth ETFs along with a handful of individual growth names. That way I could hopefully take large capital gains down the road on them and owe no taxes on withdraw. Finally in my taxable account I always focused on buying dividend aristocrats that were kinda boring but dependable in how they keep raising the dividend each year. Overall I think doing it that way was the right move for me.

sly_bdger: DUde, 90 % of people here doesnt have 100k portfoolio, so what are you talking about in the beginning? :)

turkeystand: @sly_badger i've always wondered about ages and portfolio values on sa. would be interesting to see some stats in this regard.