https://seekingalpha.com/article/4412804-investing-for-financial-independence-dividend-growth

Summary

- There are two primary styles of investing that attract Millennials to the stock market.

- One of these investing styles is FIRE, an acronym that stands for "Financial Independence, Retire Early."

- I present the case to my fellow Millennials that dividend growth investing is the best way to invest for FIRE.

Attention, Fellow Millennials!

There are two primary investing styles that attract my fellow Millennials into the stock market: (1) narrative-based momentum investing, and (2) the FIRE movement.

Narrative-based investing is partially what has driven the surging stock prices of popular, cutting-edge tech names like Apple (AAPL), Tesla (TSLA), Amazon (AMZN), Google/Alphabet (GOOGL), Facebook (FB), Twitter (TWTR), Snapchat (SNAP), Bitcoin, and ARK Innovation (ARKK). It's the narrative that fuels these soaring stocks.

Millennials like to invest in the brands they know and admire. It just seems to make sense that if you use the products all the time, then the stock must be a good investment. And what kind of product doesn't Apple make nowadays? Apple iPhone. Apple Watch. Apple Pencil. Apple TV. Apple Refrigerator. (Okay, that last one doesn't exist, but the fact that you just Google searched it should tell you something.)

The motivation behind narrative-based investing is twofold: first, to own a piece of cool companies/brands; and two, to get rich relatively quick. Because for as long as many Millennials have paid attention to the stock market, these tech names have only seemed to go up. Hashtag FOMO.

But this is not the only way to invest, nor is it the only kind of investing that has attracted Millennials into the stock market. The other is the movement that goes by "FIRE": Financial Independence, Retire Early.

People outside the FIRE movement think it's a cult. But people inside the FIRE movement say it has invigorated them and imbued their lives with a driving sense of purpose. One of the most admirable traits of the movement, in my estimation, is the requirement of participants to practice sustained self-discipline and delayed gratification.

There Is Another Way

Over the last month, after hitting a peak almost one year exactly from the pre-pandemic peak, the tech-heavy Nasdaq Index (QQQ) has been trending down. What happens if this selloff steadily continues?

You might think that these tech stocks were your last hope for a better life. But no. In the words of Master Yoda, "There is another [way]."

It's the idea of permanent financial independence. This style of investing is not about getting rich quickly or owning the coolest stocks but rather about achieving the financial flexibility to live the kind of lifestyle one wants to live.

The idea of FIRE is to amass enough savings and investments to be able to confidently quit your 9 to 5 job and be able to live out the rest of your life without needing to work again. The movement advocates a minimalist lifestyle during one's working years for the sake of saving a large portion of one's income — 30%, 40%, 50%, or more. Fabled stories and CNBC segments of engineers or software programmers that managed to retire after only 10 years of work have shown that it is indeed possible to achieve FIRE.

Now, can a Gen Xer or Baby Boomer also invest for FIRE? Yes, of course, they can, and many do. But by nature of the "early retirement" idea, the movement tends to attract Millennials and some older Gen Zers (born in the late 1990s).

According to Kevin O'Leary, a.k.a. "Mr. Wonderful," you should have $100,000 saved by the time you reach age 33. This is possible for most people, he says, if they save 20% of their income and achieve 5-7% annual returns in the market. The FIRE movement takes this advice and asks, "Why stop at 20%? Why not save more now and retire sooner?"

Of course, this is easier for some than others. If you score a high-paying job right out of college and/or live in a lower-cost area, saving 20% (or more) of your income will be easier than if you live in an expensive city with a modestly paying job.

And if you're lucky enough to escape college without debt, have a trust fund waiting for you, or have parents that bought shares of Disney (DIS) for you when you were still drinking juice from a Mickey Mouse sippy cup, you of course have a better shot at achieving FIRE. Personally, I don't think anyone should feel guilty about inheriting money or financial knowledge from their parents. It's what you do with that money or knowledge — and whether you help others as you have been helped — that should make you feel guilty or proud.

That reminds me of one of my favorite movie quotes of all time...

Remember, with great power comes great responsibility.

Shoutout Uncle Ben from Spiderman. Shoutout Stan Lee for writing that line.

But whether you've amassed money by the sweat of your brow or by winning the genetic lottery, you still need to figure out:

- What kind of FIRE strategy to pursue,

- How much is required to achieve FIRE, and

- How to invest your accumulated savings.

FIRE Strategy: Lean Or Fat?

There are basically two schools of thought within FIREdom: Lean and Fat. Neither has anything to do with one's waistline. Rather, these strategies differ by how much spending one is willing to sacrifice during one's working years in order to get to the financial freedom finish line as well as what life will look like after that finish line has been reached.

Lean FIRE is perhaps best exemplified by Mr. Money Mustache, a tech software designer who, along with his wife, retired at age 30 and now leads a very minimalist life in which he professes to spend 50-75% less on an ongoing basis than his friends.

He calls the modern American middle-class lifestyle "an Exploding Volcano of Wastefulness," because middle-income and higher-income households alike are lured into spending far more money than they need to. Why? It might be keeping up with the Joneses, effective advertising, or rising prices of luxuries.

Whatever the reason people spend too much, Mr. Money Mustache insists that over-spenders fundamentally misunderstand how to get rich. It's not about a six-figure income, picking the right growth stock, or selling your tech startup to Google. Rather, he says, "spending much less money than you bring in is the way to get rich. The ONLY way."

The same wisdom, more or less, is offered by Robert Kiyosaki in Rich Dad, Poor Dad when he insists that the way to wealth is to diligently increase your assets and decrease your liabilities over time. That simple.

So, Lean FIRE advocates say, the more of one's spending that one cuts out, the more one will have available to save. And the more one saves, the sooner one can reach the financial freedom finish line.

But what if you'd like your retirement to include some of those luxuries that you have dutifully foregone for so many years? What if you'd like to travel, eat at fancy restaurants, live in a house with adequate space for your family, and drive a nice car someday?

Well, then, you'd probably find Fat FIRE more suitable to your tastes. This school of thought argues that life is meant to be enjoyed, both now and especially as one progresses in life. While it's true that money doesn't buy happiness, it sure can enhance happiness. In the words of comedian Tosh.0, "Have you ever seen a sad person on a WaveRunner?"

Personal finance blogger Financial Samurai wrote a primer on Fat FIRE in 2020 that is enough to whet anyone's appetite. But achieving this kind of early retirement is extremely difficult for most people and requires aggressive saving, typically for many more years than Lean FIRE.

How much more? Well, truthfully, the answer will be unique to each person in their own particular situation.

How Much To Get To The Finish Line?

The standard investing strategy in the FIRE community is to rely heavily, if not entirely, on low-fee stock funds like the SPDR S&P 500 (SPY) or the Vanguard Total Stock Market Index (VTI). The idea, much like the lifestyle itself, is to minimize costs while focusing on long-term total returns.

A standard rule of thumb in determining how much one needs to retire comfortably is the 4% rule. Over long periods of time, the stock market reliably returns 7-10% per year, but to be conservative, we can add in a margin of safety and assume an indefinite withdrawal rate of 4%.

The formula is to take your desired level of annual spending and divide it by 4% (or 0.04 in a calculator). Let's say you want $50,000 of income from your investments. Divide that by 4% and you get $1,250,000. That's how much you need to reach the financial freedom finish line, according to the 4% rule. Put differently, you need to save 25 times your desired annual income to make the 4% withdrawal rule work.

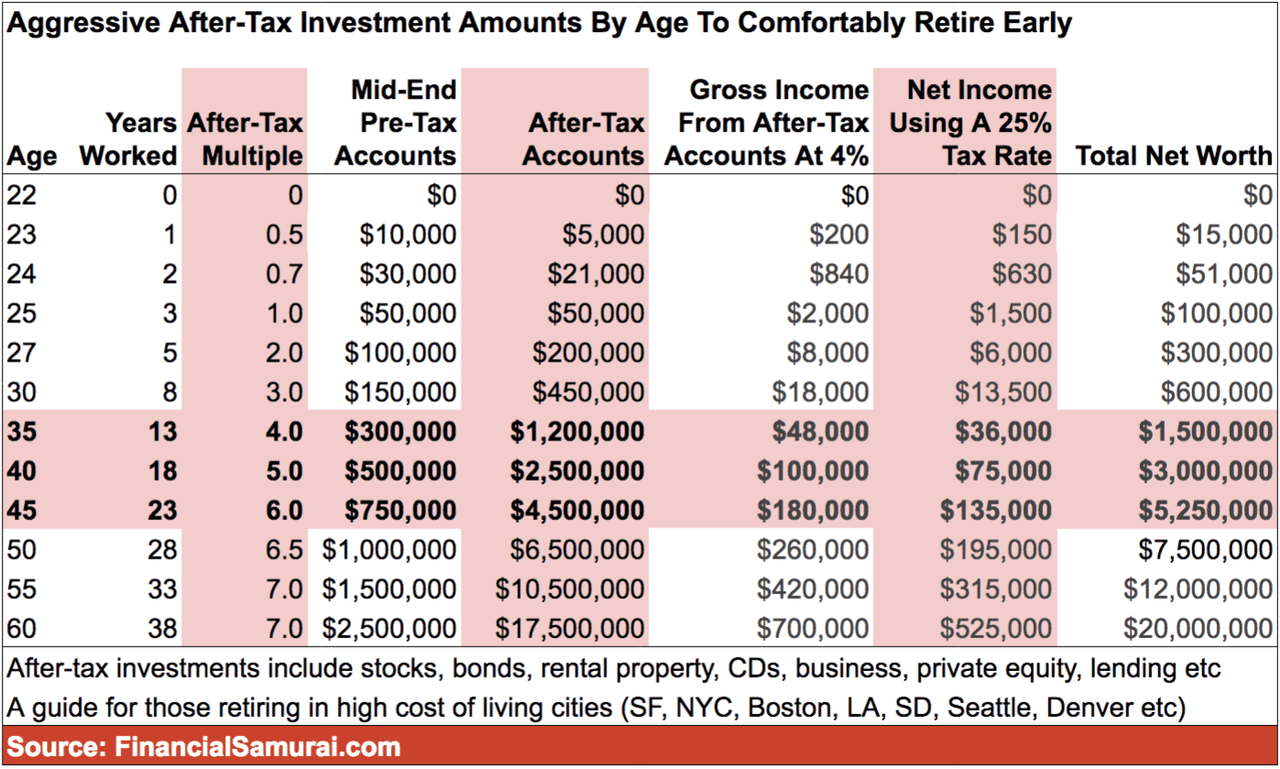

Here's a useful chart from Financial Samurai that adds taxes and retirement accounts into the calculation:

As you can see above, if you factor in taxes (as you should), then you really ought to assume a 3% withdrawal rate instead of 4%. That would get your needed total investments up to $1,666,667 to get to $50,000 in after-tax income.

What if one would like to generate $68,000 of annual income — the median American household income — in retirement? To get that using the 3% rule would require total investments of a little over $2,250,000.

Yikes! That's quite a bit of money to save and invest!

Even assuming an 8% annual return on investment and $2,000 per month contributed to one's investment account, it would take 28 years to turn $100 into $2,250,000. For a young person who begins this process right out of college, at age 23, it would still take until age 51 before hitting the financial freedom finish line.

According to Indeed, the average starting salary for a college grad is around $50,000, which means that they need to immediately begin saving almost half their income while also paying off student loans and potentially putting some money aside for a first home, a wedding, or grad school.

Could there be a better and faster way to achieve FIRE than the 4% withdrawal rule?

How To Retire A Millionaire By Age 45

I'm so glad you asked! Yes, there is a better way. In fact, it would be entirely feasible for someone starting with only $100 at age 23 to retire a millionaire by age 40 and not need to sell any of their principal in retirement.

How? Through the magic of dividend growth.

Here are my assumptions:

- $100 starting investment

- $2,000 monthly contributions

- 8% average annual stock price appreciation

- Investing in stocks with an average dividend yield of 3.5%

- Average dividend growth rate of 7.25%

- All dividends reinvested

- Income tax rate of 20%

Over the course of 17 years, the amount of money one would be investing out of pocket would come to $408,000. And yet, through the magic of rising and compounding dividends along with capital gains, one's ending balance given the above assumptions would reach just over $1 million.

See for yourself:

What about income? Well, in this hypothetical scenario, because you invested in dividend growth stocks that continued to raise their payouts year after year at a 7.25% annual rate, your weighted average yield-on-cost after 17 years is a whopping 6.5%.

The yield-on-cost ("YoC") is the amount of income generated by your cost basis. A stock's dividend yield always shows how its dividend payout compares to the current stock price, but a YoC shows how the current dividend payout compares to the price you paid for the stock, however long ago that was.

Meanwhile, the total amount invested (omitting capital gains), between $408,000 of out-of-pocket contributions and $134,727 of reinvested dividends, comes to $542,727. Given the total amount invested, then, this hypothetical investment portfolio would yield $35,277 in annual gross income.

Okay, so in this scenario, you're a millionaire by age 40, but you don't have the desired income yet.

At this point, if you have a part-time side hustle from which you could generate, say, $15,000 a year, then you can safely retire with over $50,000 of annual gross income.

But let's say you don't have a side hustle and don't want to get one. If you were to work a mere three more years, contributing the same $24,000 per year along the way, reinvested dividends would jump past your annual contribution amount to $26,706 by year 19 (age 42). By year 20 (age 43), your total amount invested would have jumped by $232,784 to $775,511.

And your yield-on-cost? Because of the additional years of dividend growth, the weighted average YoC jumps to 7.25% by year 20. That means your $775,511 of invested money translates into an annual gross income of $56,225 at age 43.

Assuming a 20% tax rate, that becomes an after-tax income of $44,980 per year. And that's without selling any stock at all!

Now, finally, tack on two more years. Between contributions and reinvested dividends, $118,650 more has been invested to reach a total amount invested of $894,161. By now, your weighted average YoC has risen to 7.3%. That means, at age 45, your annual gross income comes to $65,274 and your after-tax income is $52,219.

And remember, this is all passive and requires no drawdowns of principal!

Admittedly, achieving all of the assumptions above — especially consistently finding 3.5%-yielding stocks that continuously grow their payouts by 7.25% per year — would be quite a feat over a sustained period of time. This scenario is for illustrative purposes only. You could speed the process by investing more as you get raises at your job. Or you could change the formulation slightly by investing in higher-yielding stocks with lower dividend growth rates. Or maybe you decide to sell your Tesla stock after a nice run-up and can start the dividend snowballing effect with a larger initial "snowball."

I would estimate that about 40-50% of college graduates could do this if they had sufficient motivation. However, even most who could not want to go down this path of delayed gratification and slow-and-steady accumulation, opting instead to spend their disposable income or trying out the get-rich-quick style of investing.

Five Dividend Stock Ideas To Get You Started

Did you think I would leave you high and dry? Of course not! I'll give you five dividend stock ideas to help you get started.

- Agree Realty (ADC): This is a real estate investment trust that owns over 1,000 high-quality, omni-channel retail properties across the nation. These properties are leased to financially strong companies like Walmart (WMT), Dollar General (DG), T.J. Maxx (TJX), and Tractor Supply Co. (TSCO) that have been able to invest significant amounts of money to remain competitive in a world of rapidly rising e-commerce. In short, this kind of retail is the King Kong that can actually put up a good fight against the Godzilla of Amazon. ADC yields 3.83% and has been growing its monthly-paying dividend by 5.5% per year.

- NextEra Energy Partners (NEP): Track with me: When you plug your Tesla Model 3 (which you opted for over the Model S because you're frugal like that) into the charger, where does the electricity come from? From the utility company. Well, where do they get it? Sometimes the utility company owns the electricity generation assets — nuclear, coal, or natural gas plants, wind farms, or solar arrays — but sometimes they contract with third party owners of electricity generation assets that provide power. That third party is NEP. The company owns renewable energy assets like wind turbines and solar panels as well as some natural gas pipelines, and it sells power to utilities, governments, and corporations. The stock yields 3.31%, and NEP is set to keep growing its payout by 12-15% per year going forward.

- Merck & Co. (MRK): This is a multinational pharmaceutical company that manufactures prescription drugs for a wide variety of uses and is constantly trying to develop newer and more effective medications. I know, I know. Big Pharma Bad! But the reality is that, no matter how legislation surrounding prescription drug pricing changes in the years ahead, America's aging demographics are sure to increase demand for the products that companies like MRK supply. The stock yields 3.51%, and the dividend has been upped at an average annual pace of 5.2% over the last decade, though dividend growth has been speeding up in recent years.

- QTS Realty (QTS): We Millennials of all people should know that the world of tomorrow will rely heavily on data, and that data will need to be stored somewhere. QTS owns some of the data centers that are that "somewhere" where data is stored. They are one of the smaller data center landlords, with lots of room to grow, but they are also ranked #1 among all data center companies across the globe for sustainability. The stock offers a 3.38%-yielding dividend that will likely continue to grow at 6-8% per year going forward.

- Crown Castle International (CCI): In the world of tomorrow, data will not only need to be stored, it will also need to be transported — and fast. As 5G technology rolls out across the globe to enable innovations like the Internet of Things and communication between self-driving vehicles, the infrastructure required to facilitate this should enjoy increasing demand. CCI owns just such infrastructure, in the form of cell towers and fiber lines. The stock yields 3.52% and the dividend has been growing at 10% per year.

The average dividend yield of these five stocks is currently 3.51%, and I estimate (based on previous dividend growth and forward growth prospects) that together they will average about 8% average annual dividend growth going forward.

Bottom Line

Retiring at any age younger than one's mid-60s, when the safety net of social security benefits kicks in, is difficult. Regardless of the path, one pursues to get there, it will require living below one's means, temporarily forgoing pleasures and conveniences, setting money aside for the future, investing wisely, and sticking with the same strategy for a long time.

I would argue that dividend growth investing is the best strategy to pursue those who wish to achieve financial independence and/or early retirement. And I would also attest that anyone desirous of early retirement should combine it with a side hustle about which one is passionate, such as consulting, writing, or refereeing little league baseball games.

I believe in the value of work, but the most fulfilling work is not what pays the most but rather what one is most interested in and passionate about. To my mind, the most valuable contribution of the FIRE movement is not giving 30-year-olds the ability to quit their jobs but rather the freedom that 30-, 40-, and 50-year-olds have gained through it to pursue what they love doing, no matter how much or little it pays.

Không có nhận xét nào:

Đăng nhận xét