https://seekingalpha.com/article/4413082-make-goals-and-celebrate-investment-achievements

Summary

- The life of an investor is not an easy one. You need to keep up to date on news, happenings, your portfolio, strategy, income, and future. It is, however, rewarding.

- I believe it's crucial for anyone working in a difficult career or field to stay motivated. Create goals - short-term, medium-term, and long-term.

- Reaching goals should be celebrated, and it's something I need to improve at as well. Success should not be glossed over. Celebrate your victories - don't just move on.

- This article is about the importance of grounding and remembering where you come from, as well as where you're going.

I'm a big fan of several motivational speakers and different TV personalities from the area of finance and economics. One of the quotes or sentiments I've been thinking about lately comes from the mouth of Kevin O'Leary, AKA Mr. Wonderful.

The essence of the sentiment or message is simple (and it's not the one above). Capitalism is a wonderful thing, because it's a system that allows virtually anyone to come from zero and with hard work, perseverance, and a bit of luck, and attain freedom through finance/means.

Now, I believe that most of us here either have this ambition or some part of this interest. Through our various modalities of investment, be it in commodities, bonds, prefs, growth stocks, blue-chip dividend stocks, REITs, BDCs, micro-caps - whatever it is, we're looking to outperform the market in order to grow our personal wealth to reach larger levels of freedom.

Freedom means different things for different people and comes at different "levels" for different individuals. Some may be aiming for strictly financial freedom for the family. The freedom to take awesome vacations, or to cover some basic costs for their significant other, their children, and themselves. Maybe a bit of extra income to cover downturns in their careers or a savings account.

Others are completely on the other edge of the spectrum. Their goal is complete and utter financial freedom - hundreds of millions or billions - and the liberty to do what they want when they want, how they want with whom they want.

There's a lot of space between these two extremes. I would say for myself, I'm somewhere in between, weighing towards the complete financial freedom goal.

And I've achieved some freedom - a little bit. In nowhere near anything like hundreds of millions - but a bit of it.

The question I feel is important here is - What is freedom to you?

Goals - The importance

Goals are crucial.

I remember when I started out, my goal was literally:

Earn enough passive money to cover my monthly costs in my house and be able to do oil painting and art full time. I need $800-850/month.

That was it.

If I ever achieved that, I thought, I'd be the happiest guy in the world, being able to do what I love while essentially living a hermit's life.

That was 10 years ago, and obviously, as you can tell by my writing, by my articles, and by the way, I do this, these goals have changed.

For one, I don't want to do art for a living. It's brutal in a way I can't really handle, because I need social contexts, and people in my life in a very positive manner on a daily basis.

Secondly, I reached that goal a few years later, and as early as that, my goal had changed.

So, I set the next goal.

Earn enough passive money to cover my monthly costs and be able to do essentially what I want full time while living a normal, lower-middle-class Swedish life. I need $1500-1900/month.

I fulfilled this goal as well. The point of this is to illustrate the importance of both longer-term investment and financial goals, as well as shorter-term goals.

Goals give you focus. They allow you to measure your progress, aside from the amount of money you have. They have the potential of keeping you really locked in and potentially fight off distraction as well as procrastination. Perhaps most important of all, goals can keep you incredibly motivated throughout the incredibly hard process of doing what we do - investing.

Goals are usually personal - so the question is, What is/are your current goal/s in life, and with your investments?

Rewards

This used to be a very hard area for me - because I didn't reward myself for reaching my goals.

Instead, I just went to the next goal.

Over the past few years, this is something I've changed. I've allowed myself to increase my quality of life in a variety of specific ways. These include:

- Eating out more (good food)

- Increased food budget (I used to live on a very frugal food budget, now I buy exactly what I want)

- Nice clothes (not just business clothes, but casual ones as well)

- Specific rewards/purchases for reaching certain milestones.

I'm not a car-guy, nor do I have any other specific hobby that costs massive amounts of capital. Upon reaching my first million, I did promise myself that I would invest in my first entry-level luxury timepiece, as a symbol and a sort of "totem" for moving forward from that point.

(Source: Dreamstime)

The above watch isn't the one I might end up going with, but a Rolex is on the list for the sort of watches I'd be looking at. As originally German and grown up in Germany and spending time in Switzerland, I've always been fascinated by the craftsmanship, detail, and complexity of highly advanced mechanical timepieces and their movements, often consisting of hundreds of moving parts. While not (yet) a collector, I find the hobby interesting, and as symbols, they are certainly a statement.

(Source: Pexels)

I'm not the sort of guy to buy a Rolex just "because" it's a Rolex and sort of a symbol - but a luxury timepiece is one of the rewards I'm currently looking at.

These are just examples.

I know investors who reward themselves with clothes, such a nice new suit, an amazing cologne, a vacation on the beach, and so forth.

However you choose to reward yourself for your achievements, I believe the action of actually rewarding yourself for reaching goals Is crucial.

I do believe that your rewards should be proportionate to the goal reached. I'd never have bought a $5000-9000 timepiece for reaching a portfolio value of $100k - that's something I would have viewed as disproportionate to the goal. However, when we're talking different and higher sums, that's another argument entirely.

Rewards, dear readers, are a crucial point of what we do. Don't take this as you having to go out and buy something expensive either. Rewards can be smaller things. Take a night with your partner - or just take a breather and go for a walk, all depending on what you're celebrating.

But I do believe that larger goals should be celebrated with something more significant, to mark it for yourself and to motivate you for the next step ahead.

Because let's be honest, what we do is hard. We save, and we save and we try to have as much money as possible to put into the market for it to grow over time, in exchange for our current comforts and liberties. It's a hard thing to do in a consumer/consumption-oriented society like the one we live in.

My art teacher called it "Fighting the good fight". Every day, every year. Remember your goals, reward yourself for your successes.

And be kind to yourself.

Investments and Portfolios

Some readers might ask themselves, how on earth does this relate to anything having to do with investments? I might sound like some cheap motivational speaker, telling you to be kind to yourself, reward yourself, and set goals.

The truths in these things are universal and completely independent from specific things you're talking about - be it investments, sports, or relationships. Setting goals, rewarding yourself, and defining things for yourself is a crucial part.

I don't think I was a very good investor until I did have goals with my investments. Sure, these goals might increase once you reach them, but you should always focus on having measurable and achievable goals.

Take an investment portfolio. Your goal might be to diversify a certain way, or for your portfolio to have X or Y. These are equally important things, and more so than actually investing.

Your goals and your strategies, in the end, dictate how you invest, and for what reasons you do it. Investing without a goal in mind, or constructing an investment portfolio without a goal in mind is not a very good thing.

My portfolio, for instance, is structured and divided with my goals in mind.

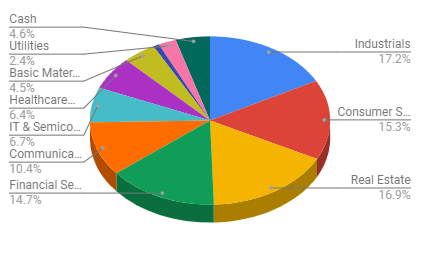

(Source: Google Sheets, Author's Data/Calculations)

You'll see that my portfolio, despite heavy investing, still holds significant amounts of cash, which is something I try to change. However, you'll see a very balanced sort of sector split (for the most part), deriving from my ambition of capital preservation, income generation, and safety.

You won't find prodigious amounts of tech stocks - less than 7% IT/Semis, and none of those in my core portfolio are a growth stock, which I view as tendentially less desirable for my goals.

While this portfolio construction tends to underperform during times of strengths in certain sectors (and corresponding weakness in others), the longer-term performance not only has beaten local indices, the dividend generation is above 4.1% while, I argue, there being real no material lack of safety in my portfolio.

I don't often talk about the specific construction of the entirety of the portfolio, but here's an example of where the portfolio currently is.

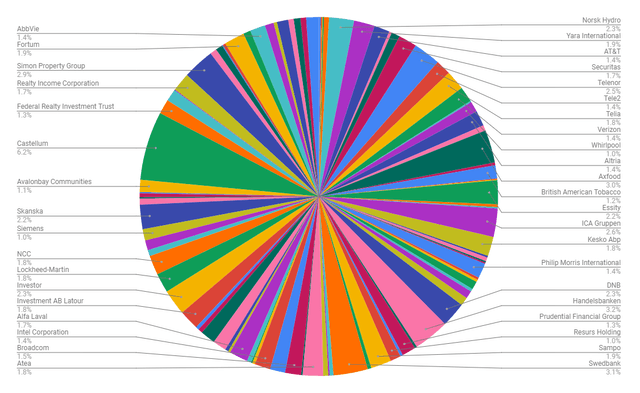

(Source: Google Sheets, Author's Data/Calculations)

These are not all positions - only the largest ones are the market. What stands out is obviously my 6.2% Castellum (OTCPK:CWQXF) position, which I've not yet been able to reduce. Castellum is expensive, but it's also worth the money. This is most people's equivalent of Apple (AAPL) or Microsoft (MSFT) for me.

My point is, your portfolio strategy should always reflect what you may require based on your goals. Me, I know that I'm not in a position where I need frequent and immediate access to capital on a regular or sudden basis. My goals don't give me this sort of situation.

So I don't hold much cash, want to reduce it even further, because the recurring cash flows from my work, from my dividends, and from other income sources cover most of what could happen. In addition, I have lines of credits that can be tapped for liquidity, if that's required.

However, you may be in a situation where you do need sudden access to cash. If that's the case, I'd probably hold a larger position in cash or some cash-like investments which can be very easily liquidated at not much, or no potential loss.

However, most of the well-to-do individuals I know, with a net worth over $10M, don't hold much, or any sort of >5% cash position. There's very little point in doing so. Timing the market doesn't work. We don't have a crystal ball, and money sitting around is money being unproductive. Money is there to invest, at least to me.

Portfolios, Investments, Goals, Freedom, and Rewards.

To some of you, this may be a bit of a confusing strategy article.

Others of you may think that "this is exactly what I needed to read." It's a sort of article that I write every now and again because not everything in investing is about investing. It's also about your mindset and how you approach your goals, your life, and how you consider all of these things.

If you're investing for a goal, and part of that goal is some sort of freedom, put down on paper what this actually means to you. if you want freedom, what will signify when you've actually reached this freedom?

Goals are connected to this concept. One of the first questions I ask my clients when they come to me is regarding their investment goals - what are they, and where would they like to be financially in 5 years, 10 years, 30 years. These are incredibly important questions, and they shape the approach you should take towards your investments.

This is incredibly crucial with regard to your investments. You should never invest in things that don't line up with your financial goals. Again, this seems such an obvious thing, so let me tell you a quick story.

I had a client, an older woman, who had investable capital of around $1.3M and who was dead set on the idea of investing in a mix of safe stocks and things like growth stocks (Tesla (NASDAQ:TSLA)) as well as cryptocurrency as well as gold. So I asked her about her goals - and she was clear, she just wanted the capital to be safe and to generate small amounts of income, better than a savings account. Most of you would probably have told her what I did - that there is no reason for her to risk her capital in higher-risk investments, and that she may either let me pick a basket of dividend-paying international blue-chips for her, or invest in a broad ETF.

Diversification only has a point if it lines up with your overall investment goals. If you diversify for the sake of diversification, I believe you've missed the point.

The Rewards part of this article is more of a personal recommendation on my part. If you're like me, and you invest for the sake of reaching certain goals, often lofty ones, I believe you deserve to treat yourself at certain milestones. It doesn't need to be an expensive watch. One of the rewards I have to look forward to at a certain milestone is a decorative item for my desk I find to be very lovely. Small things are excellent rewards. As motivational animals, I've found that many people work a lot better with such rewards to look forward to.

Try it - see if it works.

Wrapping up

Again, this is more an article on investment mindset than it is about a portfolio recommendation. It is an article about portfolio strategy - namely what you should consider when constructing your portfolio from the ground up - but there are a lot more esoteric concepts in this article to consider.

I hope you can bear with me and find something of value in the thoughts here. When I received a talk like this about 7 years ago, it certainly changed my outlook on things.

It was part of what made me open up my excel document and start jotting down goals - monthly, bi-annual and annual ones. It also made me start to consider rewards for these goals - though it took me a long time to properly implement that part of the strategy into my M.O. [?]

You can do better than me - you can motivate yourselves and push yourselves in a healthier way than I did.

The Casino & Hotel - Mapyro

Trả lờiXóaDiscover, compare and find the best 목포 출장안마 casinos in the area. - 안성 출장마사지 Find 동해 출장샵 the best 광주 출장샵 slot machines in your city - The Casino & Hotel. Mapyro 문경 출장마사지 is a